Donations are a crucial source of funding for nonprofits and charities, enabling them to continue their important work in supporting communities and causes around the world. However, traditional donation methods, such as cash and check donations, can be inefficient and time-consuming for both the donor and the nonprofit organization.

Even with new and digital payment methods, fundraisers face high levels of donor churn. Fundraisers often receive donations from individuals who only contribute once and do not become regular donors. This leaves them with unpredictable finances, making it challenging to effectively manage their organization.

To overcome these challenges and increase recurring donations, fundraisers can turn to open banking. Open banking is a system where banks allow third-party providers, like fintech companies, to access their customers’ financial data through secure APIs. These APIs provide access to features, like roundups and cashback rewards, that can drive recurring donations.

Building Recurring Donations with Roundups

Roundups are features that can be powered by open banking APIs to access donors’ bank accounts securely. They allow donors to round up their purchases to the nearest full dollar amount and donate the spare change. For example, if you buy a cup of coffee for $2.50, the API will round up the purchase to $3.00 and donate the extra $0.50.

Roundups allow for simple, frictionless giving. Over time, these small amounts add up to be significant and reliable sources of funding. Importantly, roundups do not require any purchasing behavior changes from the donor. This means the donor can shop as normal, using their preferred card, and still be able to support the cause. In addition, donors can be notified of their roundups and the impact they’ve had on the cause, engaging them more closely than before.

Enrolling and Keeping Donors with Cashback Rewards

Cashback rewards are a type of incentive primarily used by credit card companies and other financial institutions. When customers make a purchase using a payment card with cashback rewards, they receive a small percentage of the purchase amount, usually around 1-5%, back as cash rewards. These rewards can be directly deposited into donors’ bank accounts or donated back to the fundraiser, further adding to donations.

While cashback rewards are primarily marketed to consumers as a way to earn money back on everyday purchases, some nonprofit organizations and fundraising platforms have started using cashback rewards as a way to incentivize donations. By offering cashback rewards to donors who contribute to their cause, nonprofits can encourage more donors to sign up and contribute more frequent and larger donations, while donors can feel good about supporting a cause they care about and earning rewards or giving more at the same time.

Maximizing Recurring Donations with Roundups and Cashback Rewards

Combining roundup programs and cashback rewards can be a powerful tool for fundraisers looking to increase monthly recurring donations. With roundup programs, donors can easily enroll and continue using their preferred cards while making their usual purchases. Adding cashback rewards incentivizes donors to sign up, or contribute even more by offering a percentage of the rewards earned as an additional donation.

This win-win situation benefits both the nonprofit and the donor, with nonprofits receiving a steady stream of monthly recurring donations and donors being able to support a cause they care about while earning rewards. Leveraging the power of roundup programs and cashback rewards can help nonprofits maximize their fundraising efforts and make an even greater impact in their communities.

What's more, integrating these tools into existing programs is easy and doesn't require major tech investments from organizations. Fundraisers can even customize their programs to fit their own branding and offers.

.svg)

Case Study: Hope Factory - Innovative Fundraising Through Roundups and Cashback Rewards

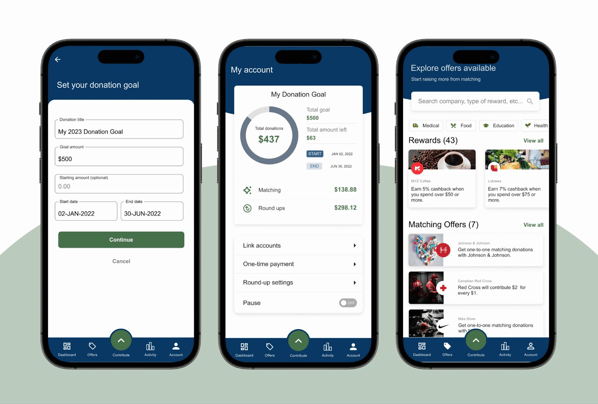

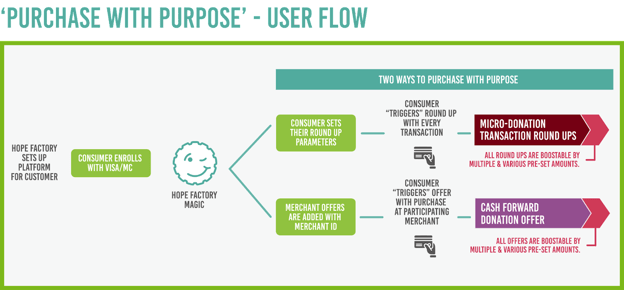

Despite the slow adoption of open banking in Canada, Toronto-based fintech company, Hope Factory has partnered with Olive to leverage Olive’s enrollment infrastructure and provisioning of rounding and cash back functionality. With the realization that societal needs are growing faster than charitable fundraising can support, the company developed a SaaS solution that boosts consumer donations and corporate philanthropy.

Hope Factory's platform harnesses consumer spend through powerful card-linking technology, enabling micro-donations (also known as "digital spare change") and donations triggered by purchases.

Here's how it works:

Fundraising organizations partner with Hope Factory to set up a platform where donors can enroll their Visa or Mastercard in a roundup program, selecting the roundup parameters (such as rounding up to the nearest $1, $2, or $5). As donors make their daily purchases, roundups are automatically triggered with each transaction. Corporate sponsors can even match the roundups for a bigger impact.

In addition, the fundraising organization can add merchant offers to the program, which are triggered when the donor shops at participating merchants. Cashback rewards earned by the donor can be donated to the organization, further augmenting the impact of each donation.

The Future of Giving is Here

The power of roundups and cashback rewards in fundraising cannot be overstated. By leveraging these tools, nonprofits and fundraising organizations can create a steady stream of recurring donations while offering donors an easy and satisfying way to give back to causes they care about. Hope Factory and Olive are at the forefront of this innovation, offering effective solutions that have already made a significant impact in the fundraising space.

If you're a fundraising organization looking to boost your impact and create more stable recurring funds, don't hesitate to reach out to Olive to see how you can get your own program up and running. With Olive's expertise and customizable solutions, you can harness the power of roundups and cashback rewards to make an even greater impact.

To learn more, chat with us here.