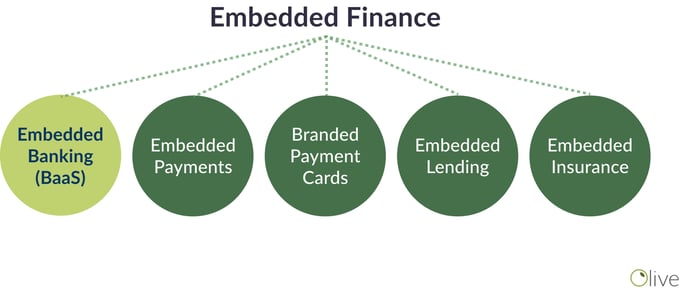

Banking as a Service (BaaS) is a business model that allows the offering of banking products and services by non-banking companies through API technology or platforms. It is also known as embedded banking, and is a specific subtype of embedded finance.

An example of BaaS might be a retail grocery chain that offers a branded debit card which allows customers to collect points and rewards with every purchase. The customer would be able to save on their future purchases, while the grocery store gains customer loyalty and valuable insight into customer behavior.

Popular Examples of BaaS

BaaS is quickly growing in popularity - especially in mature open banking markets like Europe and Australia, and shows strong growth potential in the U.S. and Canadian markets as well. Globally, BaaS sales are forecasted to surpass US$12.2 billion by the end of 2031.

Some prominent examples of BaaS include:

Lending Club

The Lending Club Tailored Checking Account allows small businesses to open accounts online within 10 minutes. In addition to cashback, it also offers mobile wallets, debit cards, bill pay, business checks, ACH origination and more. Much of the Lending Club’s capabilities are enabled by fintech partners, including Treasury Prime and Marqeta which offers access to banking services and card issuing through the Treasury Prime API.

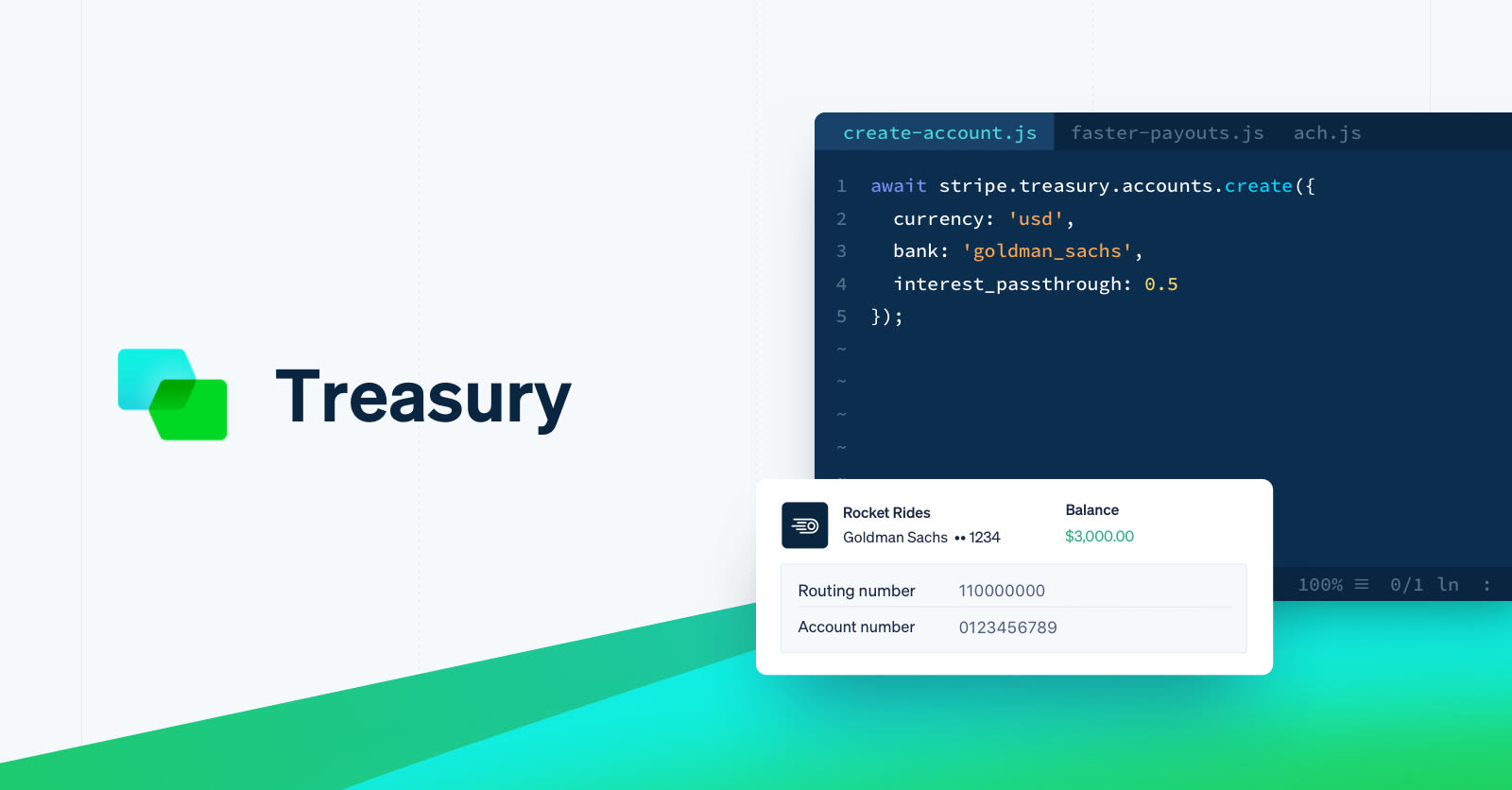

Stripe Treasury

Stripe Treasury is a BaaS API that allows users to embed a variety of financial services into their platforms or marketplaces. The integration allows for account creation including identity verification and KYC checks, storing of funds, money movement, and attaching payment cards.

Shopify Balance

Shopify Balance, in partnership with Stripe Treasury and Evolve Bank, is a business bank account for Shopify merchants. It includes a physical and virtual card, which can be used to pay bills, make purchases and withdraw cash. It also includes cashback, money transfer, money management, and early payment.

Why is BaaS Important?

Like the other subtypes of embedded finance, BaaS removes friction from the consumer journey. It’s especially useful in the e-commerce and retail space, as players jostle to differentiate themselves and capture customer loyalty through added services and greater convenience. It has even been shown that banks focused on offering BaaS services 2x the return on average assets (ROAA), highlighting the potential of this field.

Key Takeaways

BaaS allows non-financial companies to offer banking services to decrease consumer journey friction and improve consumer engagement, and is helping to modernize traditional banking infrastructure.

Banking-as-a-Service and Olive

As an embedded finance platform, Olive delivers open finance services for clients. We expand our capabilities beyond financial data by focusing on outcomes. What kind of outcomes? Simply put, the ones that matter for your customers, and therefore, for your business. Whether it's helping to invest, save, donate or purchase, Olive can power goals.

For more information, check out Olive's use cases. You can also chat with an Olive expert.