The customer loyalty program is, on paper, a great idea for companies. They get to acquire customers with the promise of savings, rewards and discounts, and once the customer is signed up, they get to retain them around for a longer time. After all, the probability of selling to an existing customer is about 60 to 70 percent - that's a lot better than the 5 to 20 percent chances companies have of selling to a prospect.

Unfortunately, most customer loyalty programs falter.

About 77% of loyalty programs that rely only on a transactional model fail in the first two years. Customers are unable to navigate complicated rules on earning and redeeming points and rewards. Companies cripple under the weight of carrying unredeemed points. Offers aren't personalized and appealing to the customer. And oftentimes, loyalty programs don't have an omni-channel strategy.

About 69 percent of consumers say their choice of retailer is influenced by where they can earn customer loyalty/rewards program points.

This is where roundups, earning and redeeming on rounded up change from purchases, can come in as an innovative solution for customer loyalty programs.

What are roundups?

Roundups allow users to automatically round up their purchases to the nearest dollar and save the difference. For example, companies and banks focused on their customers' financial health and wellness allow their users to roundup a $1.50 purchase to $2.00 and save the extra $0.50 into a financial goal created by the user. That financial goal can be building up emergency savings, saving up money towards a big purchase like a mortgage or travel plans, regularly donating or investing and more!

.png?width=475&height=447&name=Frame%2030006%20(1).png)

Users can set their savings goals based on amount and time frame and will constantly update your progress to make it more engaging for consumers.

The app also allows flexible roundup options, where users can round up to the nearest dollar $2, $5, or even $10.

Some apps also allow users to set a maximum amount for rounding, or to choose which purchases to include in the roundups.

What are the benefits of roundups?

Roundups instantly and automatically reward good behavior. For consumers trying to create the difficult habit of saving or investing, the instant reward makes it easy and engaging. Consumers do not have to think about saving money because with roundups, it’s automatic.

Many might wonder how roundups affect financial well-being. The power of compound growth can grow small amounts of money to considerable amounts over a large period of time. For example, saving $50 a month and putting it into an investment account that yields 10% per year can grow to more than $400,000 over a working career. Although investment returns are not guaranteed, the power of compounding can grow wealth considerably more than depositing regular into savings accounts.

How can roundups accelerate customer loyalty programs?

Rounding can be paired with loyalty programs to create an effective and engaging experience of their customers. For example, consumers can earn points for every purchase they make plus additional points for every roundup they complete. About 69 percent of consumers say their choice of retailer is influenced by where they can earn customer loyalty/rewards program points.

Loyalty programs are not new, but designing an effective program that boosts customer retention can be difficult. This is especially true during periods of rising costs and economic uncertainty where consumers start to reduce their spending.

Loyalty programs are marketing strategies designed to provide consumers rewards such as discounts, cashback rewards and points in the hopes that they will develop a stronger relationship with the brand.

The most common type of loyalty program is point based, where consumers earn points through each purchase which can be redeemed for a free item, discounts or even a cash back. The consumer would most likely need to sign up with the brand to earn points, and can take time before any reward is actually earned.

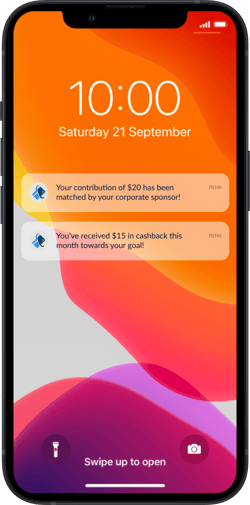

The new approach for customer loyalty programs as real time rewards powered through roundups. In this way the consumer would not need to sign up to any brand offers and can start earning rewards right away after connecting their primary credit card.

Empower your rounding program with Olive

Olive's embedded finance platform offers easy-to-integrate rounding, matching and rewards features to any customer loyalty program. Your customers can start dedicating funds for their next purchase, while also redeeming customizable offers and rewards.

We're happy to discuss your program goals and how Olive can supercharge your customer engagement metrics. To learn more, reach out to us here.