Open banking, open finance, embedded finance and Banking-as-a-Service (acronymized as BaaS) are popular topics in finance, and fintech especially, for their capability to disrupt and reshape how banks and non-bank financial institutions, fintech companies, businesses and consumers interact with financial data and services.

Therefore, business leaders and partners should be aware of the distinctions between the terms, and how to properly refer to them.

In this article, we define open banking, open finance, embedded finance, and BaaS, clarifying distinct features of each. We show how these ideas are currently being used, and how businesses can start incorporating them into their strategic roadmaps.

Quick definitions of open banking, open finance, embedded finance and BaaS

Open Banking

Open banking refers to the secure sharing of consumers’ banking data between banks and other non-bank financial institutions (FIs) with financial technology companies (or fintechs), primarily through websites and apps. As it involves these three parties (the consumer, the bank/non-bank FI, and the fintech), open banking allows for the sharing of banking data specifically (hence its name), which includes account information and payments initiation. With open banking, fintech companies are able to provide a number of services, such as:

- Account aggregation where consumers can see multiple bank accounts across banks in one dashboard;

- Transactions tracking where consumers can categorize payments and view spending habits, tracking financial goals and set spending limits;

- Service comparison where consumers can shop for the best deals;

- Know your customer (KYC)

- And more.

For more in-depth information, check out this article on open banking.

Open finance

Open finance is a concept that enables access to and sharing of consumer data to more financial products and services than available with open banking. A central idea within an open finance system is that data supplied by and created on behalf of consumers are owned and controlled by those consumers.

Under open banking, consumers are able to own and control their banking information, which includes account and payments information. With open finance, consumers are able to own and control their financial data, which includes:

- Mortgage,

- Pension,

- Investments,

- Insurance, and more.

For more in-depth information, check out this article on open finance.

Embedded finance

Embedded finance, simply put, is when a non-financial company offers financial products and services through APIs and platforms. Embedded finance allows companies to access and utilize financial services provided by third parties. This, in itself, is not new - consider that retail stores have offered branded credit cards for years, like Macy’s or Costco.

What is new about embedded finance these days is the technological capabilities. Quick and easy integration into easy-to-access digital interfaces, such as apps, digital wallets, rewards programs, insurance, and more is making embedded finance highly attractive to businesses and consumers alike.

For more in-depth information, check out this article on embedded finance.

Banking-as-a-Service (BaaS)

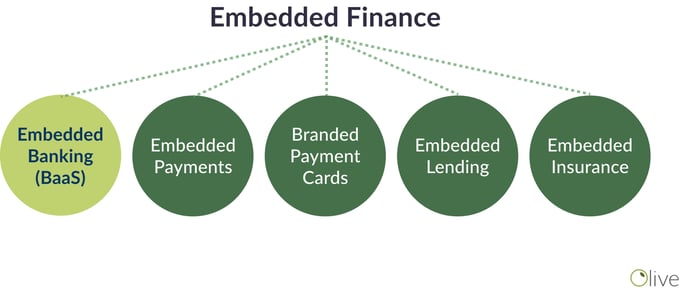

Banking as a Service (BaaS) is a business model that allows the offering of banking products and services by non-banking companies through API technology or platforms. It is also known as embedded banking, and is a specific subtype of embedded finance.

An example of BaaS might be a retail grocery chain that offers a branded debit card which allows customers to collect points and rewards with every purchase. The customer would be able to save on their future purchases, while the grocery store gains customer loyalty and valuable insight into customer behavior.

For more in-depth information, check out this article on Banking-as-a-Service (BaaS).

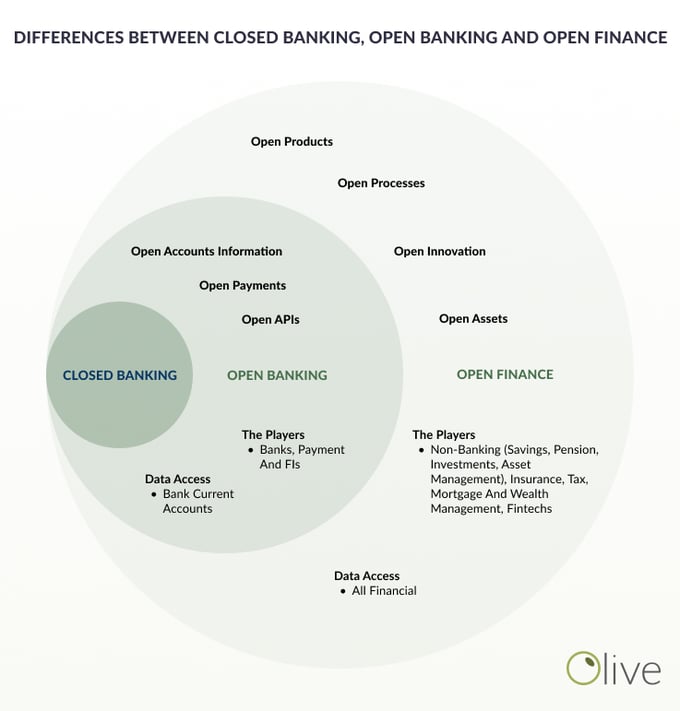

Open finance and open banking refer to the regulations and technology that allow for secure and easy sharing of financial data. Open finance encapsulates more financial data than open banking → concentric circles

Embedded finance and Banking as a Service, on the other hand, refer to business models and/or service offerings. In fact, BaaS is a form of embedded finance, and is sometimes referred to as embedded banking. Some companies may offer these services, in which case, the terms correctly identify their businesses.

Comparisons between open banking, open finance, embedded finance and BaaS

When we talk about open banking and open finance, we are referring to the system and processes in place to help guide the secure, fast and efficient transfer of financial information between banks and other financial institutions, customers and third-parties (such as fintech companies).

Open banking and open finance create a safe ecosystem for which data and payments can move between parties. This involves government regulation, APIs and digital infrastructure.

Embedded finance and BaaS, on the other hand, are financial solutions that companies can offer in order to create a better customer experience.

Therefore, when comparing these four terms, we should group them into two: open banking versus open finance, and embedded finance versus BaaS.

Comparing open banking and open finance

The key difference between open banking and open finance is scope size. Simply put, open finance is the logical evolution of open banking, incorporating more types of customer data, and thus, more capabilities.

As can be seen in its definition, open banking applies to banking data, allowing for account information and payment initiation services. For example, with open banking, consumers could review all of their bank accounts in one place and easily move funds between them.

Open finance, on the other hand, applies to banking and financial data, incorporating savings, pension, assets, investments, insurance, tax and more. For example, with open finance, consumers could review all of their financial accounts in one place, including bank, savings, investments, asset accounts and more. This capability would allow customers to have a clear, top-down view of their financial situation.

Comparing Embedded Finance and BaaS

Embedded finance and BaaS are both tools, generally software solutions, that businesses can incorporate, particularly in order to improve certain customer outcomes, such as sales, retention, satisfaction and more.

The key difference between embedded finance and BaaS is also scope size. Embedded finance refers generally to the offering of financial products and services by non-financial companies. An example of embedded finance is when a travel company offers customers the option to add-on travel insurance to their vacation booking.

BaaS, on the other hand, is the specific offering of banking services by non-financial companies. Some banking services that might be offered are account opening, branded payment cards, money transfer and more.

BaaS is also known as embedded banking, and in fact, is a subcategory under the greater umbrella term of embedded finance.

Open finance solutions by Olive

As an embedded finance platform, Olive delivers open finance services for clients. We expand our capabilities beyond financial data by focusing on outcomes. What kind of outcomes? Simply put, the ones that matter for your customers, and therefore, for your business. Whether it's helping to invest, save, donate or purchase, Olive can power goals.

For more information, check out Olive's use cases. You can also chat with an Olive expert.