Rounding sounds simple: spare change from everyday purchases gets tucked away for something good—whether that’s growing a savings account, making a charitable donation, or investing in the future. But building a great rounding program takes more than just flipping a switch.

The best rounding programs are intentional. They’re shaped by a clear goal, backed by user insights, and built with the right tech and timing. And depending on who you are: a nonprofit looking to boost donations, a fintech embedding micro-investing, or a savings app helping users reach financial goals, your ideal setup might look very different.

In this article, we’ll walk through the foundational steps to help you launch smarter. From validating your audience to designing the right experience and choosing your vendor, you’ll learn what makes a rounding program truly effective and how to avoid common missteps along the way.

1. Define your “why"

Start with your purpose

Before you dive into the mechanics of a rounding program, take a step back and ask: What exactly are we trying to achieve?

Are you rounding up for charitable donations? Helping users build a savings cushion? Enabling micro-investments or paying down debt a few cents at a time? Your “why” will guide every decision that follows: from the user experience to how you measure success.

It’s also important to clarify whether your primary outcome is emotional or financial. For nonprofits and cause-driven brands, the emotional payoff might be the focus: empowering users to do good effortlessly. For fintechs and savings platforms, the financial benefit—automated saving, faster progress toward goals—may take the lead.

Whatever your angle, make sure it aligns with your broader mission. A well-integrated rounding program should reinforce your product’s core value or your organization’s larger purpose.

Pro Tip: Set a measurable target. A goal like “$50/month in automated savings per user” or “$10 million in donations in the first year” helps keep your team focused and aligned as the program grows.

2. Know your audience

Validate demand before you build

Even the best-designed rounding program will fall flat if it doesn’t resonate with your audience. Before you write a single line of code, talk to potential users. Do they already donate regularly? Are they trying to save but struggling to stick with it? What tools do they use today, and what frustrates them?

Try to uncover what really motivates them. Is it automation and convenience? A sense of impact? Feeling in control? These insights will help you shape a program that actually gets used.

You don’t need a big research budget. Start with a short survey, a handful of user interviews, or behavioural data you already have. The goal is to understand whether rounding fits naturally into their habits and goals, or if they’d rather have a more direct way to save, donate, or invest.

Tip: Rounding isn’t one-size-fits-all. What works for a donor audience might not work for first-time savers or seasoned investors.

3. Make key program decisions

Shape the core experience

Once you’ve defined your purpose and validated the demand, it’s time to make the foundational choices that will shape how your rounding program works day to day.

Start with enrollment. Will users need to opt in, or will you auto-enroll them and let them opt out later? Opt-in creates more intention; auto-enroll typically boosts participation. Just be sure it aligns with your brand’s approach to consent and transparency.

Next, decide how rounding will actually happen. Will you round up to the nearest dollar, to the next $2 or $5, or allow users to set their own rounding preferences? Then determine the timing: contributions can be processed in real-time, at the end of the day, or in weekly batches.

Also, consider the destination of the funds. Will all contributions go to a single cause or savings account, or can users choose where their change goes?

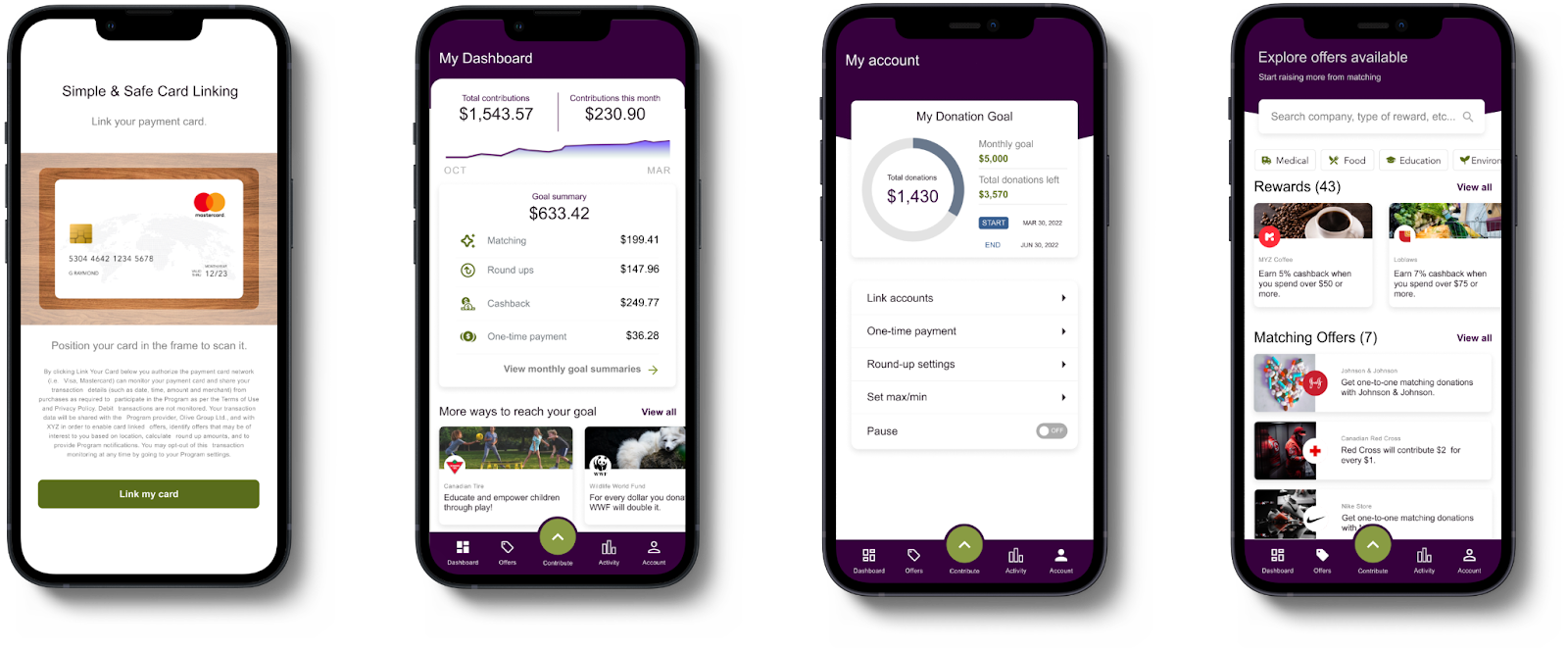

UX Callout: However you set it up, users should always feel in control. That means clear options to pause, cap, or edit their contributions, and a clean interface that makes managing the program feel effortless. Autonomy builds trust, and trust builds loyalty.

4. Build a flow

To build a rounding program that drives real engagement, you need more than just a backend integration—you need a clear, intuitive customer flow that brings the experience to life.

Start by identifying key touchpoints. When will users encounter the option to round? For some, it might be during onboarding, when setting financial goals, or linking a payment method. Others might introduce rounding at checkout, during a seasonal campaign, or through a targeted email or in-app prompt.

Once a user opts in, think about what happens next. Will they receive a confirmation message? Will their dashboard update in real-time to reflect contributions? What kind of tracking will they see: daily totals, cumulative impact, goal progress?

Also, consider how and when to surface feedback or nudges. Will users get a weekly summary? A monthly milestone update? A notification when they hit a savings goal or reach a $100 donation mark?

Pro Tip: Visualizing the full journey in a simple flowchart—from discovery to first contribution to ongoing engagement—can help your team align on UX and identify any friction points early.

5. Pick the right tech stack and vendor

Evaluate infrastructure early

Behind every great rounding experience is a solid technical foundation. One of the first decisions you’ll need to make is whether to build your program in-house or partner with a rounding platform.

If you’ve got internal development resources and a long runway, custom-building may offer more control. But if speed, scalability, or compliance are concerns, a trusted vendor can help you get to market faster with fewer headaches.

As you assess your options, weigh key factors:

- Time to market — How quickly do you need to launch?

- Developer bandwidth — Can your team support ongoing maintenance?

- Data access — Do you need real-time reporting or insights?

- Cost — What’s your budget for setup and ongoing fees?

- Compliance — Are PCI or charitable regulations involved?

Choose a partner who aligns with your goals - whether you need plug-and-play infrastructure, embedded UX components, or deeper data integrations to grow over time.

6. Design a dashboard that builds trust

Show progress clearly

A well-designed dashboard turns passive users into engaged participants. At a glance, users should be able to see:

- How much they’ve rounded so far

- Where their money is going

- The impact or growth of their contributions over time

Transparency builds trust so make the data meaningful. Use clean UI, smart defaults, and timely updates to keep users informed without overwhelming them.

For nonprofits, lean into storytelling. Visuals that show the real-world impact of donations can deepen emotional connection. For fintech or savings apps, offer projections, milestones, and goal-setting to show users the payoff of staying consistent.

A good dashboard doesn’t just display information, it motivates the next contribution.

7. Bring in marketing early

Don’t leave growth as an afterthought

Marketing shouldn’t wait until launch day. Start shaping your positioning and messaging while the program is still in development. This helps ensure the experience and story align from the start.

Whether you're promoting financial peace of mind or the joy of effortless giving, highlight the emotional or financial payoff in simple, compelling language.

Fuel adoption with opt-in nudges, referral incentives, and early user testimonials. Create space in your marketing plan for iterative campaigns and in-product prompts.

Bonus: Build excitement by teasing future features like milestone rewards, gamified savings streaks, or impact badges. The right roadmap gives users a reason to stick around.

Make it count from setup to impact

Rounding is simple in theory, but when done right, it can be a powerful tool for driving financial wellness or social impact. The key is thoughtful setup: understanding your audience, making intentional choices, and building a seamless experience from day one.

Whether you're launching to boost donations, encourage saving, or fuel micro-investments, a well-built program can deliver real results for both your users and your organization.

👉 Ready to build smarter? Download our full checklist to guide your launch and avoid common pitfalls.